I recently started my investment journey. I have invested in Mirae Asset Tax Saver (Rs 40,000 over the past 5 months) and Quant Tax Plan (Rs 1,000).

Which one must I continue with? Mirae Asset Tax Saver seems to be more volatile over the period my investment with lesser returns.

When it comes to Equity Linked Savings Schemes, or ELSS, we have reviewed a few funds in detail:

I have done in-depth analysis of a few funds from Mirae Asset. The fund house has a relatively stable and experienced investment team that adheres to a research-intensive process. The fund is managed by Neelesh Surana, who is an extremely skilled and experienced manager.

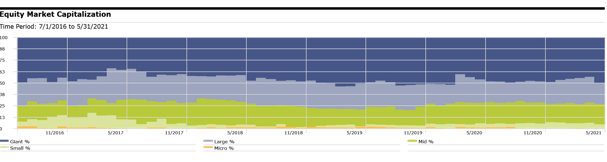

Mirae Asset Tax Saver is a consistently managed strategy with a focus towards picking stocks with a Growth at Reasonable Price (GARP) framework. The fund invests predominantly into large-cap stocks with an allocation of 20-30% into mid and small caps. This allocation has been consistently plied as observed below.

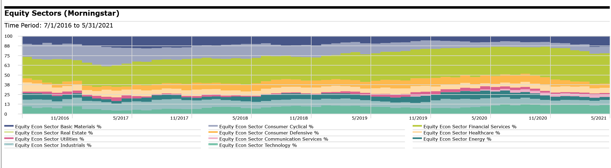

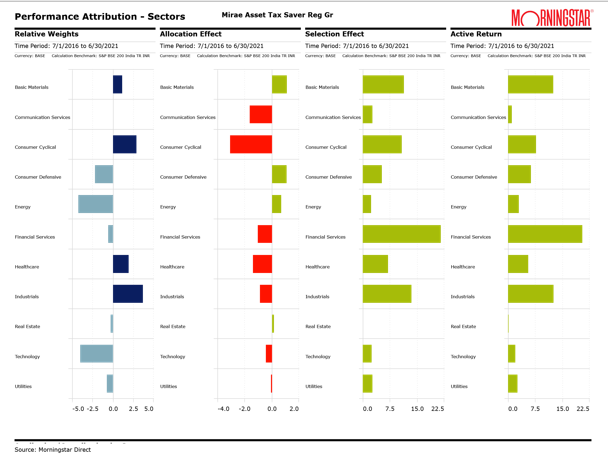

The overall stock and sector allocation has been broad based. The Performance Attribution analysis of the fund suggests superior stock selection by the manager consistently across sectors over a longer time horizon.

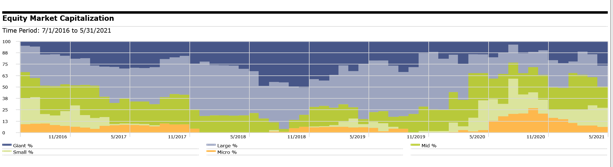

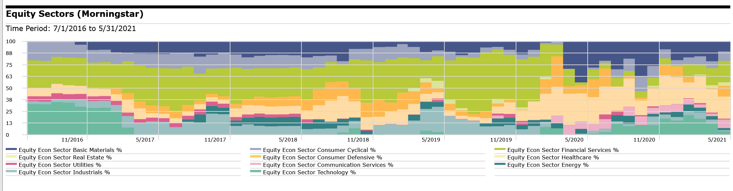

Quant Tax Plan is run with a flexible investment approach in terms of sector and capitalization exposures. The fund has fair bit of changes in the portfolio driven by their investment framework of VLRT - Valuation, Liquidity, Risk appetite, and Time.

There have been significant changes made in the sector allocation as well as market-cap allocations as per their model over the years. In the past, the fund has had a significant allocation to large caps. More recently, the portfolio has largely been allocated to mid and small caps which have had a stellar run in the last 12 months.

The recent performance of the fund has been due to its significant exposure to mid and small caps and the Healthcare sector. While sector rotation could work over a longer term, it can be accompanied by greater volatility.

We recommend holding onto Mirae Asset Tax Saver. As for Quant Tax Plan, it would be prudent to assess how well the investment process is plied over a longer term.

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries ONLY relating to mutual funds and portfolio planning.